We Studied AmEx’s 2025 Price Hike - and Found a Roadmap for Dealers

How Confidence per Dollar™ Turns Price Into Trust.

When a $200 fee increase triggered 500,000 early upgrade requests, it wasn’t luck - it was psychology. We unpacked the data and found the same pattern that separates strong dealerships from discount-driven ones: visible value, explained math, and customer confidence.

American Express’s latest quarter showed a 16 % surge in profit, powered largely by high-income cardholders. But hidden in that headline is a deeper signal: in 2025, AmEx raised the price of its Platinum Card by $200, layered on new perks, and still saw demand-and brand engagement, rise faster than forecast.

In a cautious economy, that’s not just impressive. It’s instructive.

The Split-Screen Economy

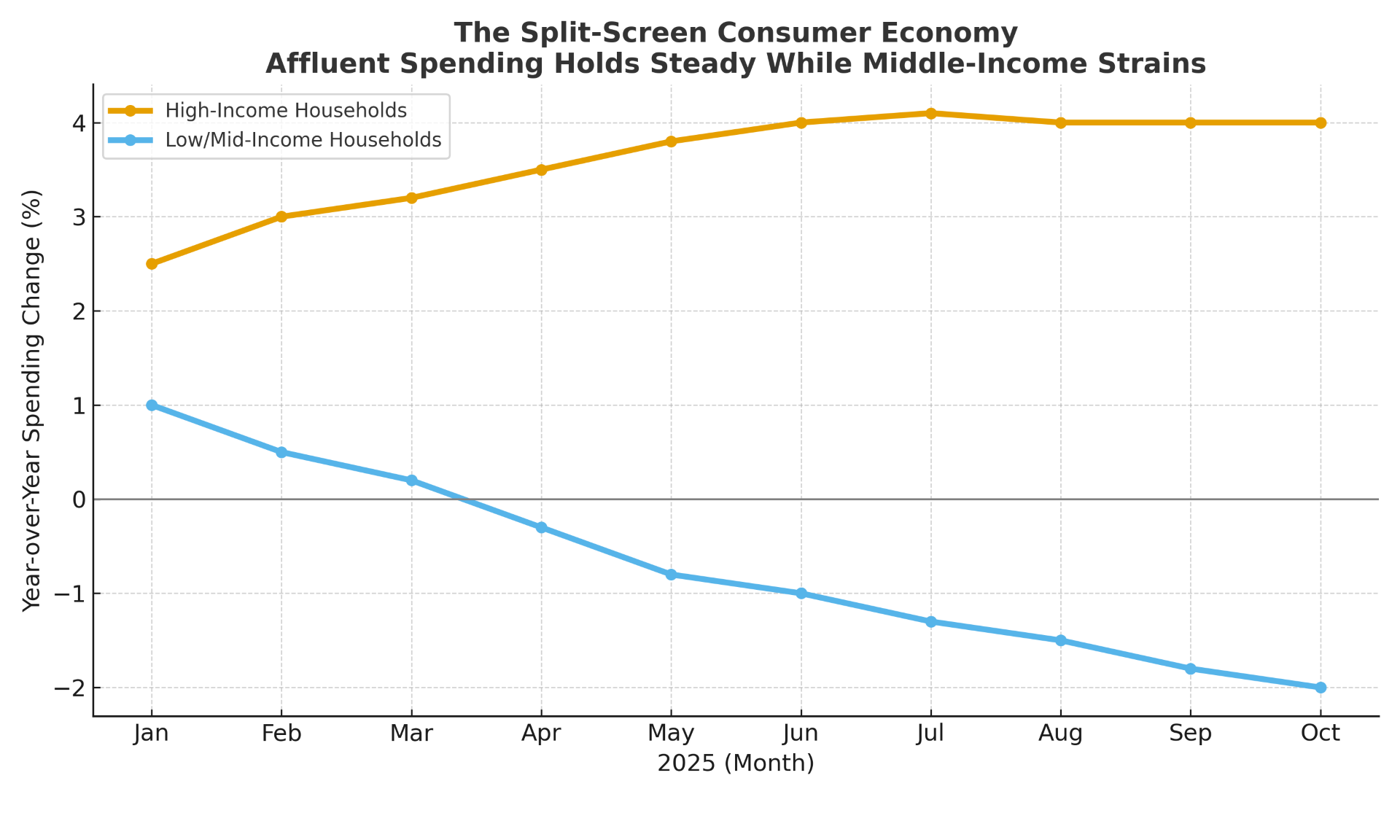

Across the consumer landscape, we’re seeing two Americas:

Affluent households continue spending freely on travel, dining, and experiences.

Middle-income buyers are scaling back, pressured by higher borrowing costs and declining savings.

Bank of America Institute data (Aug 2025) shows high-income spending up roughly 4 % year over year, while mid- to lower-income spending is down 2 %. Meanwhile, BEA data shows disposable income flattening and savings dipping to multi-year lows.

That divergence explains why AmEx-and any brand serving premium customers—can expand even as others stall.

The Platinum Principle - 2025 Edition

In September 2025, AmEx raised the Platinum Card’s annual fee from $695 → $895, the first hike in four years. Alongside the increase came new perks: expanded hotel and dining credits, enhanced digital-entertainment benefits, and travel lifestyle partnerships promising more than $3,500 in potential yearly value. (Reuters)

Many questioned the move. Instead, AmEx’s rollout became a case study in loyalty acceleration. Within three weeks, 500,000 existing cardholders requested to convert to the new mirrored-finish design-a milestone the company expected to reach by year-end. (AP News)

This wasn’t just about aesthetics; it was about momentum. Customers were eager to signal belonging to the upgraded experience.

Why It Worked

Clarity beat cost. Every new benefit was clearly itemized, tangible, and usable from day one.

Confidence was reinforced. The higher fee became a proof point that the product was premium, not predatory.

Experience felt instant. Members saw and felt the upgrade—no small thing in a market drowning in fine print.

Brand conviction. AmEx didn’t apologize for the price. They explained it—and delivered on it.

Translating the Lesson to Auto Retail

Dealers face the same equation every day: customers evaluating price through the lens of trust.

AmEx’s move shows that a higher price can build confidence, not resistance, when paired with transparency and clear upside. That’s the essence of the Confidence per Dollar™ framework.

| Dealer Focus | Translation of the Platinum Playbook |

|---|---|

| Explainable Margin |

Don’t hide the math—show how each dollar translates into reliability, convenience, and resale strength. |

| Experience as Value |

Upgrade waiting areas, service delivery, or digital follow-ups so the price feels earned, not extracted. |

|

Tiered Benefits |

Loyalty tiers or service perks reframe retention as privilege, not persistence. |

| Pricing as Signal |

A transparent premium signals quality and stability—especially when competitors chase discounts. |

The Bigger Context: The K-Shaped Consumer Curve

High-income spending is stable and growing; middle-income spending is contracting.

The takeaway: pricing power exists—but only for those who earn trust and articulate value.

The Takeaway

American Express didn’t grow by cutting fees.

They grew by raising expectations and delivering clarity fast.

Dealers can do the same. Raise confidence, not discounts. Build explainable margin into every offer.

Because in any market, the real currency isn’t price-

it’s Confidence per Dollar™.